Recently, Infini Card — once seen as a fast-growing crypto payment player — abruptly shut down its global crypto card business. The shutdown has reignited industry concerns over the sustainability of crypto payment business models. Thin cash flows, shrinking profit margins, rising compliance costs, and elevated settlement expenses ultimately overwhelmed the platform’s financial capacity. But while Infini’s collapse is still fresh, a new wave of platforms is emerging with even more complex financial structures designed to extend the illusion of fast growth.

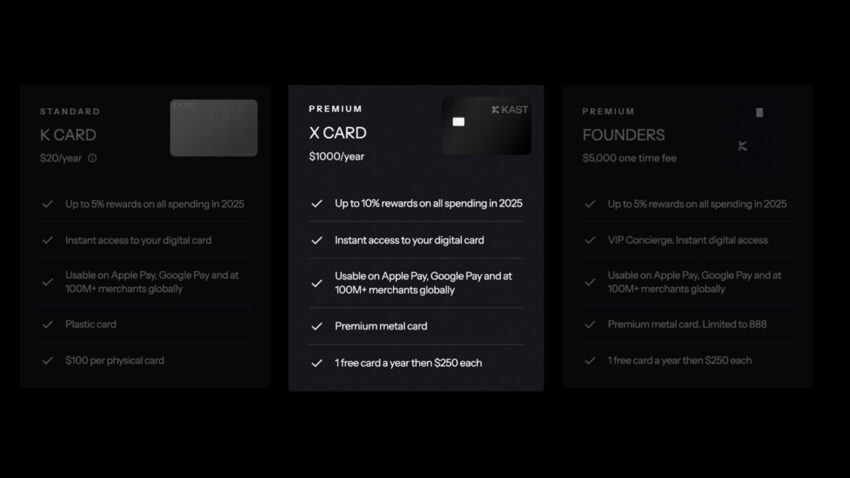

Among them, KAST has gained significant attention by providing up to 10% cashback in Kast points that diverges sharply from traditional cashback logic. Unlike conventional cashback, where users receive spendable cash or stablecoins after each transaction, KAST offers reward points that cannot be redeemed immediately. These points can only be converted into KAST’s native token after a future Token Generation Event (TGE). Even then, users face unlock schedules and secondary market volatility before any real cashback can occur.

On the surface, this model provides platforms with substantial short-term financial flexibility. Because issuing points requires no immediate cash outlay, projects can fuel early-stage growth while minimizing near-term funding pressure. The high cashback rates easily attract users, who may overlook that what they’re receiving is essentially a deferred, unguaranteed token generation promise.

At its core, every point issued is a future redemption obligation. As the pool of outstanding points grows, the system’s dependency on new capital inflows and future token price appreciation deepens. Continuous user acquisition and fresh liquidity injections are required to absorb the eventual selling pressure in the secondary market. If user growth slows or market conditions deteriorate, systemic redemption risk can surface rapidly.

Some platforms may indirectly rely on ongoing venture funding to act as a backstop — propping up token prices, maintaining market confidence, and delaying redemption pressure. While these capital infusions are often presented as growth funding, portions of them may effectively be diverted toward supporting token liquidity and price stability, masking the system’s underlying fragility.

Fundamentally, tokenized cashback doesn’t eliminate redemption obligations — it simply hides, delays, and compounds them over time. Every token distributed today creates a real cash flow liability that must eventually be paid. If the platform’s underlying profitability fails to match the mounting token liabilities, aggressive cashback incentives may ultimately push platforms toward sudden collapse scenarios.

The structure echoes risks we’ve seen before. In recent years, platforms like Celsius, Voyager, and others have employed similarly leveraged growth models: attracting users with high-yield promises while lacking sufficient sustainable profits to backstop those obligations. When market conditions reversed, funding dried up, and regulators stepped in, these systems unraveled with astonishing speed, leaving behind a trail of collapsed tokens and unrecoverable user losses.

Unlike Infini, which directly burned through cash while propping up unsustainable cashback offers, KAST shifts the burden to the future through tokenization. Short-term it appears healthy, but long -term redemption liabilities are becoming bigger and bigger.The combination of volatile token prices, uncertain unlocking schedules, fragile secondary market liquidity, and escalating reliance on ongoing fundraising creates a delicate systemic risk that may eventually unwind sharply.

Regulatory uncertainty further complicates these models. Are such tokenized cashback schemes effectively unregistered securities? Do they cross into the realm of illicit fundraising? Have users been given full, transparent disclosure of their true redemption rights and risks? In a global environment of rapidly evolving crypto regulation, these questions may get more and more attentions from regulators.

In an industry where stable profitability remains elusive, the business model needs to return to fundamentals: real profits fund cashback; rewards are immediate and spendable; and users’ rights are clear, predictable, and free from complicated token economics.

Infini’s collapse may not be an isolated incident. As tokenized cashback models continue to expand aggressively, perhaps now is the moment for the industry to pause and reflect on what truly constitutes sustainable financial innovation.

The more compelling the growth story sounds, the more important it becomes to recognize the ballooning redemption hole quietly growing behind it.